In its first year, The Outdoor Foundation’s Thrive Outside Community Initiative has made multi-year grants to four regions across the country (San Diego, Oklahoma City, Atlanta and Grand Rapids) to build and strengthen networks focused on providing children and families with repeat and reinforcing experiences in the outdoors. Our communities are finding unique ways to positively impact their communities during the COVID-19 crisis.

We’re proud to share the ways one Thrive Outside Atlanta organization, West Atlanta Watershed Alliance, are continuing to connect with and serve their local youth.

“Providing accessible, sensory-based, outdoor programming through technology”

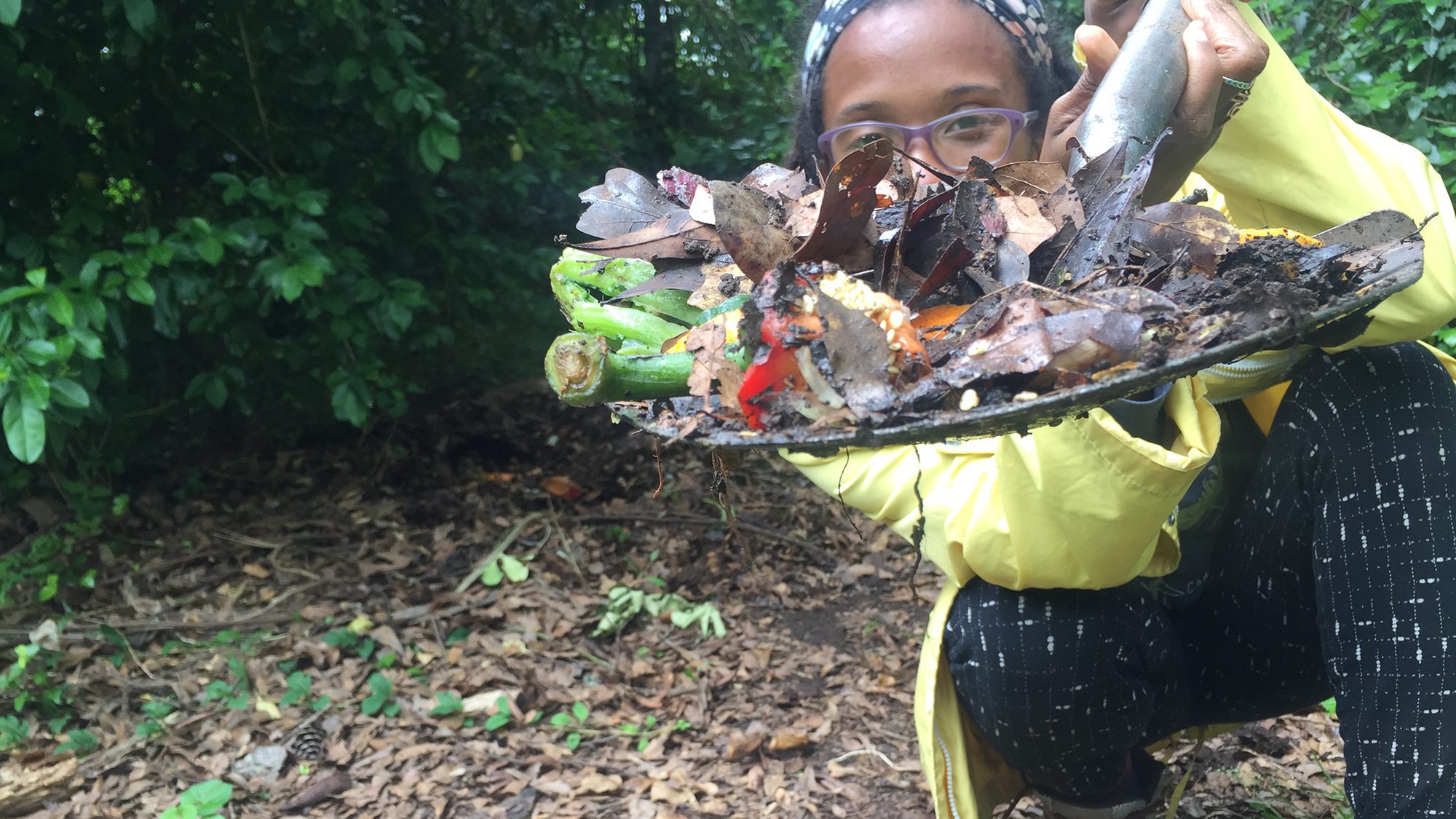

With a curriculum that typically encourages the use of our senses for learning and exploring, shifting to online curriculum initially seemed to be a daunting task for us at West Atlanta Watershed Alliance (WAWA).

At WAWA, we believe that the power of play, inquiry instruction, social constructivism and cultural relevance are foundational principles of environmental education pedagogy. We quickly identified a crossroads between our pedagogy and technology in order to offer sensory-based livestreams in lieu of O-ACADEMY, our spring break camp.

When developing content for digital audiences in response to COVID-19, there were a few important factors to consider including digital accessibility, exercises that can be completed outdoors, and sensory-based engagement with youth. Because some residents in our community struggle with access to technology to complete daily tasks such as school-based distance learning, we decided to use accessible social media platforms including Facebook and Instagram to host content, because we know many of our constituents utilize these channels. With COVID-19 anchoring us all at home, we chose programs that could be done outdoors and with little supplies. Lastly, we wanted to ensure the programs feel participatory, and so, we encourage families to grab household items and participate in programming that draws on our senses to enhance our understanding of the outside world.

One of our programs “Sensory with Soils” provides youth a learning opportunity from simply playing in the dirt. During this program, we encourage the touch and observation of soil types to understand the benefits and best uses of each soil.

We also generated a survey among our online communities to determine if the increased digital content was useful or overwhelming. The results of this survey will help us to determine how we continue developing digital content and through which platforms we deliver it. WAWA will continue to provide accessible, sensory-based outdoor programming for digital audiences throughout the COVID-19 pandemic, and we look forward to adding more digital offerings to our environmental education moving forward.

Anamarie Shreeves,

Environmental Education Programs Manager,

West Atlanta Watershed Alliance (WAWA)