Speakers:

Lise Aangeenbrug – Executive Director, Outdoor Industry Association

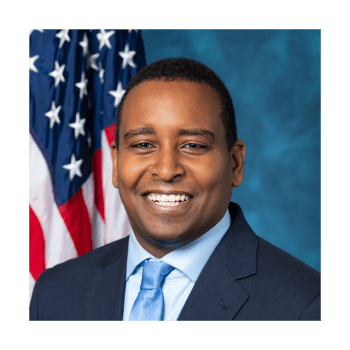

Representative Joe Neguse (D-CO-02) – Chairman of the House Natural Resources Committee’s Subcommittee on National Parks, Forests, and Public Lands

Key Takeaways:

1. For the outdoors to thrive, it must be open and accessible to all.

2. The American Jobs Plan is a historic opportunity to make a difference on climate – now is the time for the outdoor industry to step up and urge Congress to act.

3. A Civilian Climate Corps will provide jobs and economic growth AND combat climate change and conserve green spaces for generations to come.

4. As outdoor climate policy priorities take center stage, your business voice matters.