Read highlights from The Summit, our industry’s next steps, and how you can get engaged. Take a look at photos from the event and a thank you to our sponsors here.

In service of OIA’s mission to support the long-term success of outdoor businesses and ensure the outdoor experience for all, we hosted The Summit last month, a first-of-its-kind event bringing together 100+ leaders across the outdoor ecosystem to collaborate and commit to act on the most pressing issues – and greatest opportunities – of our time: climate change and outdoor equity.

Our intention for The Summit was for business executives, community-based partners, and policymakers to come together and make bold commitments toward a shared future that is inclusive, equitable, and climate positive. We knew that in order to be successful, this event required a different approach and design than industry convenings in the past, and we engaged community leaders and businesses across the outdoor ecosystem to co-create The Summit. It took over a year of planning, learning, and growing along the way.

While The Summit is just the beginning, we are proud to see the progress our industry made through engaging in authentic conversations, challenging what we think we know, stepping into discomfort, and agreeing to collective action. Read on for highlights, our next steps, and how you can get engaged.

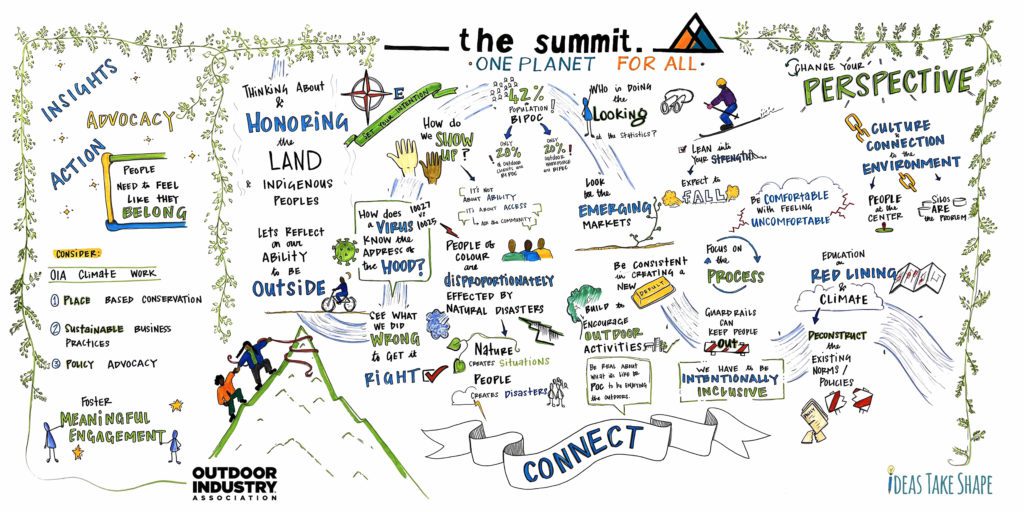

Together at The Summit, outdoor leaders:

1. Learned about the links between climate, equity, and inclusion and why they are vital to securing our shared future.

- Historian and award-winning journalist Jelani Cobb set the stage for engaging conversations on the dynamics of race in our society, relating the country’s history of inequality to today’s issues, including climate change.

“The only way in which we have ever made social progress is by beginning to recognize our own fallibility, our own complicity and then proactively saying: it is incumbent upon us to do something different … the willingness to step aside from our comfortable position and ask ourselves how we factor, how we benefit, how we replicate the kinds of pre-existing conditions that we see routing disaster through that societal rain gutter to the most vulnerable parts of our population.”

“The only way in which we have ever made social progress is by beginning to recognize our own fallibility, our own complicity and then proactively saying: it is incumbent upon us to do something different … the willingness to step aside from our comfortable position and ask ourselves how we factor, how we benefit, how we replicate the kinds of pre-existing conditions that we see routing disaster through that societal rain gutter to the most vulnerable parts of our population.”

- Dr. Cobb joined our opening panelists Dr. Carolyn Finney, Middlebury College and Chris Speyer, REI to bring this historical context into a discussion about the present-day ethical and business drivers for bold, urgent action on climate, equity and inclusion. We learned that while diversity is accelerating in America, only 28% of the outdoor participant base is BIPOC (black, indigenous, and people of color) – off pace with the general population and that 3 in 4 BIPOC persons live in nature-deprived places, compared with 1 in 5 white persons. We explored our role as business and organizational leaders in both creating, perpetuating, and solving for these disparities.

2. Amplified the leadership power already evident in outdoor community-based organizations and demonstrated what it looks like to meaningfully engage in sustained, healthy partnerships.

- At Anacostia Park, Thrive Outside D.C. community leaders and program participants led Summit attendees through a series of outdoor activities that highlight how the local community utilizes the park for healing, community, and growth.

- During the Ally to Accomplice session, panelists shared struggles and successes in our journey to overcome equity barriers to the outdoors, along with real-life partnerships that put trust in community leaders and build relationships that go beyond financial transactions.

3. Empowered and equipped each other to expand audiences, connect with customers beyond the transaction, and demonstrate our industry’s values and capacity for doing good.

- Halla Tomasdottir, CEO + Chief Change Catalyst of The B Team, and Ryan Gellert, CEO of Patagonia, shared how successful stewardship of our businesses can exist alongside responsible stewardship of our communities and planet, along with practical guidance on how to implement a leadership model that places humanity at its heart.

- Climate change is not just a math problem: It’s a social justice issue and a threat to the outdoor experience for all. To break the cycle of injustice, bold action is needed across all sectors. Climate leaders and experts from YETI, Burton, and LifeStraw shared the ups and downs of setting science-based greenhouse gas reduction targets and meeting them. And a panel of climate finance experts illuminated how our banking decisions can support or undermine all that effort.

- Senator Angus King, I-ME, and Shannon A. Estenoz, Assistant Secretary For Fish And Wildlife And Parks, shared how businesses can help the administration take proactive and ambitious steps to preserve our public lands, combat climate change, make investments in green infrastructure, promote environmental justice, and ensure that the outdoors are open and accessible to all.

4. Built our leadership capacity for candor by listening and engaging in difficult conversations about equality and climate change.

- Dr. Gerilyn Davis, Founder and Chief Inclusion Officer of Inclusion on the Slopes, and OIA Board members shared real-life examples and tactics to help business leaders model inclusive behaviors, foster psychological safety, and build a fearless outdoor ecosystem.

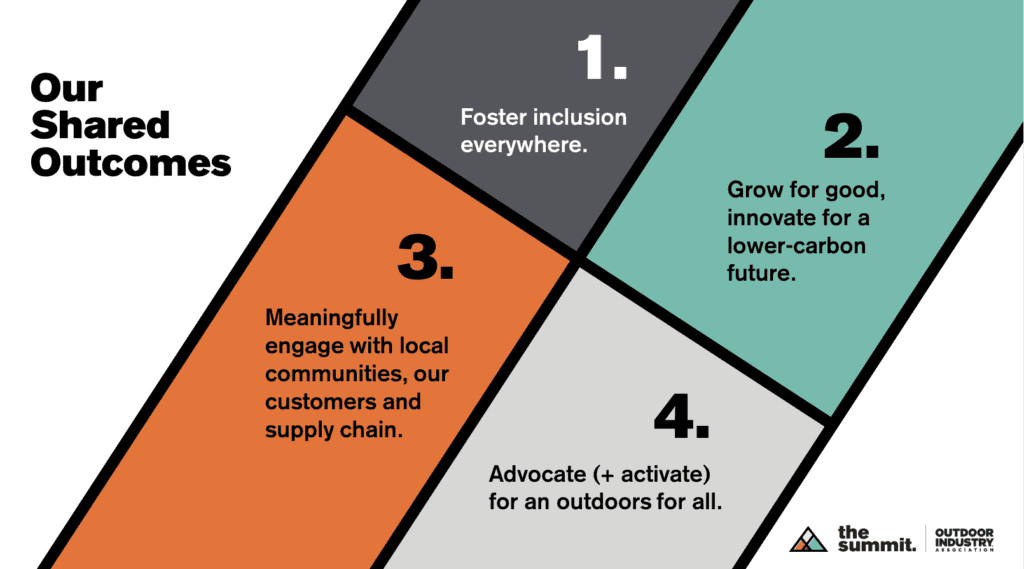

5. Co-created and committed to act on a shared 2030 vision for an inclusive, equitable, and climate-positive future.

- Our force for change is a compelling vision that clarifies what our most passionately held desire for the future is. We were blown away to see the hundreds of visionary ideas generated by participants that collectively represent what this community most wants to see become a reality by 2030 on climate, equity, and inclusion – and what you’ll do to make it happen!

- See our 2030 vision + outcomes framework and meeting report-outs, and details below on how to contribute.

OIA is committed to the following immediate next steps to support our members and partners:

Finalize the 2030 vision.

Finalize the 2030 vision.  With your feedback and in consultation with partners and members, we will draft the next version of our shared 2030 vision and desired outcomes and share it back with the outdoor community this summer. This will serve as our collective North Star. The OIA staff and Board will use this to inform our strategy – including new programs and partnerships to advance climate and inclusion action. See below for how to contribute!

With your feedback and in consultation with partners and members, we will draft the next version of our shared 2030 vision and desired outcomes and share it back with the outdoor community this summer. This will serve as our collective North Star. The OIA staff and Board will use this to inform our strategy – including new programs and partnerships to advance climate and inclusion action. See below for how to contribute!

- Be a resource for action on equity and inclusion. While we already operate a thriving climate program called the Climate Action Corps, we want to do more to support our members to take immediate and holistic action on equity and inclusion – across product design and development, marketing, supply chain, and outdoor participation. OIA will conduct a deeper assessment of member needs, existing programs, potential partners, and gaps in this space to determine how we can play a unique and valuable role. We do not intend to reinvent the wheel; many great resources are already available, and we intend to align with and support existing programs wherever possible.

- Continue to advocate for inclusive and equitable climate policy, especially at this pivotal time as Congress weighs significant and consequential climate legislation. We will also continue our advocacy for federal, state, and local policies that help ensure an outdoors for all.

- Set the date and location for our next Summit in the Spring of 2023, as well as a separate D.C.-based fly-in to bring back our traditional annual lobbying event.

- Cultivate community on these business imperatives and beyond. In the meantime, OIA will explore the creation of cohort-based “meet-ups” that enable smaller groups of executives and teams to connect more frequently on common challenges and solutions that are critical for business success.

Here’s how you can continue to learn and act between now and our next opportunity to gather:

- If you did not attend the meeting, or just have more to say, contribute to our 2030 vision + outcomes by clicking here and following the prompts to add your ideas and let us know what you need to take action.

- Action on climate and equity is easier when you can collaborate with your peers. Join the OIA Climate Action Corps and sign the In Solidarity Outdoor CEO Diversity Pledge if you have not already – then, take a stand and make your commitment public! If you have already done both, how can you take your commitment to the next level?

- Sign on to this timely climate policy letter by June 9, urging Congressional action on bold emissions-reducing legislation. It may be our last significant moment for the scale of climate policy action needed to help all companies and the U.S. achieve our climate targets.

- Money doesn’t just sit in a bank – it goes out in the world and finances things. Find out whether your company’s money is helping fund a sustainable future or fueling the climate crisis, and learn how you can take action.

- Join this list to stay informed on OIA’s work in these spaces.

- Stop by this Outdoor Retailer session on Thursday, June 9 at 3:30 MT to get a deeper look into what happened at The Summit and what’s next.

OIA is the trusted convenor, resource, and voice of the outdoor industry in the U.S. We collaborate to support the long-term success of outdoor businesses and ensure the outdoor experience for all. When you become a member of OIA, you gain access to the insights, action, and advocacy opportunities to help your organization and the greater outdoor ecosystem thrive.

Did you attend The Summit and are interested in connecting with speakers? Contact us.

For media inquiries, please contact Quinn Trainor at quinn@dennyink.com.