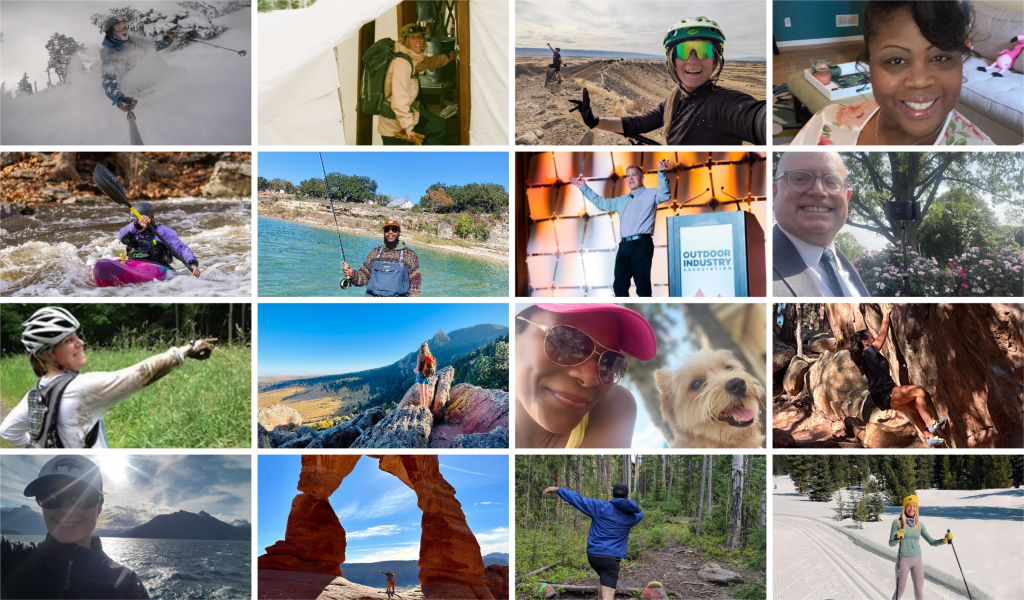

In 2023, Outdoor Industry Association (OIA) and the outdoor community experienced a transformative journey marked by change and growth. With fresh faces on board and a revamped OIA member portal, innovation became our driving force, fueled by the unwavering support of members and fellow outdoor enthusiasts like you. Together, we catalyzed meaningful change across every focus area of OIA, from market research and sustainability to government affairs and inclusive participation.

We launched a new program, Clean Chemistry and Materials Coalition, to help our members phase out and eliminate harmful chemistry in outdoor products, and our Climate Action Corps continues to grow in helping members reduce greenhouse gas emissions in line with science

We shared 20 research reports delivering expert perspectives and industry-leading data on participation trends, market intelligence, and consumer insights.

Our virtual education series, featuring 12 webinars, covered topics from sustainable product development to effective outdoor advocacy at state and federal levels.

We stood strong in advocating for our industry, with members testifying before the House Ways and Means Committee to champion international trade priorities.

Through the Outdoor Foundation‘s Thrive Outside initiative, we grew the impact of this nationwide network, expanding outdoor access for 390,000 diverse youth. But our innovation doesn’t stop here.

We have four product launches on the horizon for 2024 to help our members continue to move the needle for business, people, and the planet.

Together, we are catalysts for sustainable growth, collective action, insights, and inclusion. Together, we are catalysts for meaningful change. Thanks for treading the path with us.

Sincerely,

OIA President Kent Ebersole